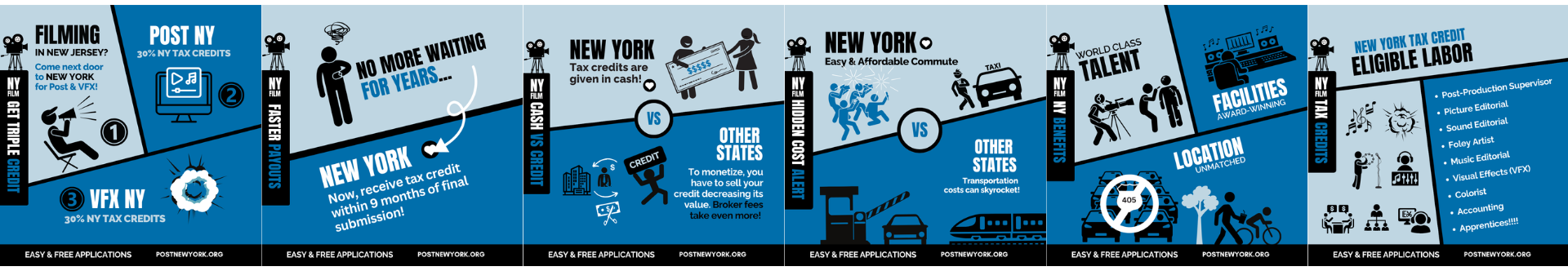

New York State offers some of the most competitive and accessible tax incentives for post-production services in the film and television industry. With a 30% tax credit on qualifying costs, New York provides direct cash payouts, unlike other states where credits must be sold to monetize them—often reducing their value due to broker fees. The program covers a wide range of roles, including sound editorial, visual effects (VFX), music editing, and even apprenticeships. New York also boasts world-class talent, award-winning

facilities, and unmatched locations, all complemented by an easy and affordable commute for crew and talent. Payouts are expedited, now processed within nine months of final submission, ensuring timely support for productions. Even projects filmed in neighboring states like New Jersey can maximize these benefits by conducting their post-production in New York. With an easy and free application process, New York is the ideal choice for post-production work. Learn more at PostNewYork.org.